Taken from Winning Methods of the Market Wizards............

It’s interesting to see that at a time like this, a time of economic concern, a time of confusion, that many people (including traders) get caught up in information that doesn’t serve them in any way helpful. What do I mean by this? Well, if you look at most financial news networks or most financial news services out there, how often of the time are they serving us information that is helpful in any way to our trading?

In New Market Wizards, Jack Shwager interviews a very successful trader. During the interview he asks him:

“Can you tell who will be a successful trader and who will not?”

The traders response is very interesting. He goes on to say:

“Yes, on a less technical level, I can say that after years of studying traders, the best predictor of success is simply whether the person is improving with time and experience. Many traders unconsciously acknowledge their lack of progress by continually jumping from one system or methodology to another, never gaining true proficiency in any.

As a result, these people end up with one year of experience, six times, instead of six years of experience. In contrast, the superior traders gravitate to a single approach-the specific approach is actually not important-and become extremely adapt to it.”

Now, most traders would read that and think nothing of it. But look at how he talks about how most traders jump from system to system, never really gaining true proficiency in any. This is something I have come to observe as well within most traders. When I try to understand why this is happening it seems that it’s the same reason each time.

As traders learn more and more about different indicators and patterns in the market, they become more and more desperate to find this “holy grail” system that will produce some astronomical winning results. Not only that, but they continuously jump from doing one thing to another. One day they’re trading moving averages, the next day they’re trading a bear wedge pattern, the next day a double top; they’re just all over the place. Why is this? It goes back to the quote up top. Instead of focusing on ONE methodology and mastering it, what happens is as soon as a losing streak comes along or a trade doesn’t work out the way they would have liked, they begin to think that something is wrong with the system, when in fact the real problem is the trader himself.

I often talk about how trading is a business and how it needs to be taken seriously if you want to succeed. A lot of traders approach the markets like they approach Las Vegas, with hopes and dreams. You fund your brokerage account and you think that you’re going to hit the “jackpot”. You sit down at the computer and you have no plan and no rules, and then you’re surprised when you start losing money.

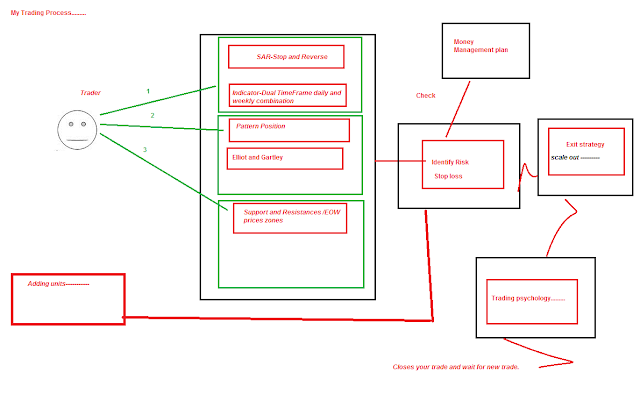

The only way you’re going to be successful at this game called trading is by doing what successful traders do. What do they do? All the ones I’ve talked to have very specific rules to entering or exiting the markets. They know where their stop is before even getting in. They know where they are taking profits before they get it in. They don’t jump in and just “see what happens”. Just as important, they all have a very specific systematic way of trading. They operate from an if/then scenario. They think from a probabilities perspective and they know exactly what their odds are every day,week, month and year.

Here are a couple of things you should ask yourself:

1. How far have I progressed as a trader?

Have I mastered a system?

Can I perform it consistently without effort?

2. What am I doing to insure my growth and success?

How will I measure success?

Am I constantly growing and developing?

So as you go into your trading, I want you to remember that successful traders are constantly improving with time and experience using a single approach or methodology. It’s important to realize that without that mindset, you are likely to get caught in the same trap that most other traders get into. That is no plan, no rules, and no success.