Trading Futures and Options on Futures involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

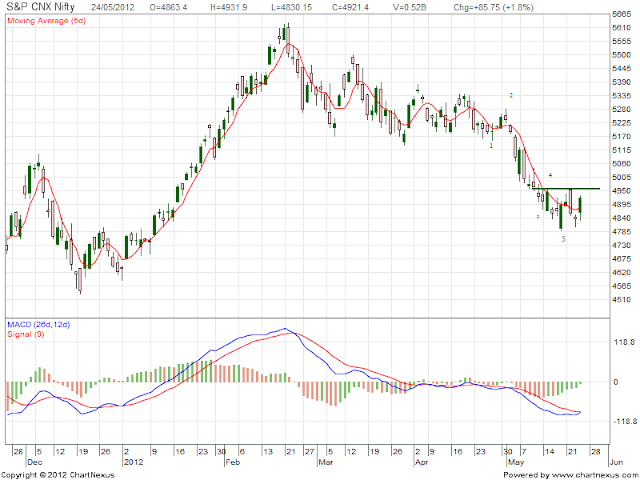

May 26, 2012

Trading Checklist........

RULES FOR TRADING SUCCESS:

1.Trade with minimum 4 lots for 3 star trade.

2.Divide trade as 1star, 2star,3star trades on basis of profit objectives.

3.Profit taking will be on basis of longer timeframe support and resistance.

4.My first objective is to make trade risk free trade.

5.Significant high and low in longer time frame can also be used as Profit targets.

6.I am committed to take next 30 trades.

7.Stop loss should be on market structures rather fixed money amount.

8.Accepting the Risk or ignore the trade.

9.Effectiveness of edge will be determined on basis of 30 trades.

10.Sample Size of 30 trades.

11.Trading in its simplest form, I would say that it is a pattern recognition numbers game.We use market analysis to identify the patterns, define the risk, and determine when to take profits. The trade either works or it doesn't. In any case, we go on to next trade.

12.Stop loss would be never more then 30 points.

13.In case of gap up or Gap down , if stop loss rule is violated , I will close my position immediately.

THE 5 FUNDAMENTAL TRUTHS OF TRADING:

1. Anything can happen.

2. You don’t need to know what is going to happen next to make money.

3. There is a random distribution between wins and losses for any given set of

variables that define an edge.

4. An edge is nothing more than an indication of a higher probability of one thing

happening over another.

5. Every moment in the market is unique.

THE 7 PRINCIPLES OF CONSISTENCY:

1. I objectively identify my edges.

2. I predefine the risk of every trade.

3. I completely accept the risk or I am willing to let go of the trade.

4. I act on my edges without reservation or hesitation.

5. I pay myself as the market makes money available to me.

6. I continually monitor my susceptibility for making errors.

7. I understand the absolute necessity of these principles of consistent success

and, therefore, I never violate them.

TO ACHIEVE CONSISTENCY , I SHOULD

1.Be able to identify an edge (trading method)

2.Have a trading plan on how to utilize the edge

Risk Parameter , Money Management (Position Size), Profit Objectives

3.Able to execute the edge without making trading Error

4.Think in probabilities

5.Making a mental shift from trade to trade perpective to series of trade perpectives

6.Believing that you dont have to know what is going to happen next on trade by trade to win or make money.

7.Develop the ability to recognize you have crossed the thresold from normal self confidence to the state of euphoria.

TRADING ERRORS

1.Not defining the risk is the biggest trading error

2.Let the winning trade turn into a loser without having taken any profits.

3.moving a stop closer to entry points ,getting stopped out and market trade back into your favours.

4.hesitate -getting in too late

5.jump the gun -getting in too soon where signal never actually develops

6.Thinking ,Assumming or beleiving you know what is going to happen next , creates unreleastic expectation in specific outcome.

"What does it mean to think in probabilities?

It means to believe at the very core of our identity that:

anything can happen

every moment is unique

there is a random distribution between wins and losses on any given set of variables that define an edge

Each one of these beliefs will keep your expectations in line with what is possible from the markets perspective. To the extent your expectations correspond with what is possible from the markets perspective, you eliminate the potential to define and interpret market information as painful.Ultimately ~ you can get to the point where you can trade from a "carefree" and "objective" state of mind where you are making yourself available to perceive and act upon whatever the market is offering you in any given "now" moment from its perspective."

1.Trade with minimum 4 lots for 3 star trade.

2.Divide trade as 1star, 2star,3star trades on basis of profit objectives.

3.Profit taking will be on basis of longer timeframe support and resistance.

4.My first objective is to make trade risk free trade.

5.Significant high and low in longer time frame can also be used as Profit targets.

6.I am committed to take next 30 trades.

7.Stop loss should be on market structures rather fixed money amount.

8.Accepting the Risk or ignore the trade.

9.Effectiveness of edge will be determined on basis of 30 trades.

10.Sample Size of 30 trades.

11.Trading in its simplest form, I would say that it is a pattern recognition numbers game.We use market analysis to identify the patterns, define the risk, and determine when to take profits. The trade either works or it doesn't. In any case, we go on to next trade.

12.Stop loss would be never more then 30 points.

13.In case of gap up or Gap down , if stop loss rule is violated , I will close my position immediately.

WHY DO I TRADE?

I TRADE TO BE CONSISTENTLY PROFITABLE.

I trade what I SEE, not what I think.

I cannot control the market, I can only control MYSELF.

My trading mindset is the key to being SUCCESSFUL.

I will not be biased as where the market is going.

I BELIEVE the markets are 100% psychological.

I strictly adhere to my RULES.

Losing is a part of the business.

Trading is a business and I am here to PROFIT.

1. Anything can happen.

2. You don’t need to know what is going to happen next to make money.

3. There is a random distribution between wins and losses for any given set of

variables that define an edge.

4. An edge is nothing more than an indication of a higher probability of one thing

happening over another.

5. Every moment in the market is unique.

THE 7 PRINCIPLES OF CONSISTENCY:

1. I objectively identify my edges.

2. I predefine the risk of every trade.

3. I completely accept the risk or I am willing to let go of the trade.

4. I act on my edges without reservation or hesitation.

5. I pay myself as the market makes money available to me.

6. I continually monitor my susceptibility for making errors.

7. I understand the absolute necessity of these principles of consistent success

and, therefore, I never violate them.

TO ACHIEVE CONSISTENCY , I SHOULD

1.Be able to identify an edge (trading method)

2.Have a trading plan on how to utilize the edge

Risk Parameter , Money Management (Position Size), Profit Objectives

3.Able to execute the edge without making trading Error

4.Think in probabilities

5.Making a mental shift from trade to trade perpective to series of trade perpectives

6.Believing that you dont have to know what is going to happen next on trade by trade to win or make money.

7.Develop the ability to recognize you have crossed the thresold from normal self confidence to the state of euphoria.

TRADING ERRORS

1.Not defining the risk is the biggest trading error

2.Let the winning trade turn into a loser without having taken any profits.

3.moving a stop closer to entry points ,getting stopped out and market trade back into your favours.

4.hesitate -getting in too late

5.jump the gun -getting in too soon where signal never actually develops

6.Thinking ,Assumming or beleiving you know what is going to happen next , creates unreleastic expectation in specific outcome.

"What does it mean to think in probabilities?

It means to believe at the very core of our identity that:

anything can happen

every moment is unique

there is a random distribution between wins and losses on any given set of variables that define an edge

Each one of these beliefs will keep your expectations in line with what is possible from the markets perspective. To the extent your expectations correspond with what is possible from the markets perspective, you eliminate the potential to define and interpret market information as painful.Ultimately ~ you can get to the point where you can trade from a "carefree" and "objective" state of mind where you are making yourself available to perceive and act upon whatever the market is offering you in any given "now" moment from its perspective."

May 24, 2012

May 21, 2012

May 20, 2012

Subscribe to:

Comments (Atom)